U.S. Rep. Mike Kelly's bill would bar IRS from offering free online tax filing services

On average, preparing and filing taxes costs Americans more than $150 a year, and despite the passage of the "Taxpayer First Act" last week, it seems that number isn’t going to get lower anytime soon.

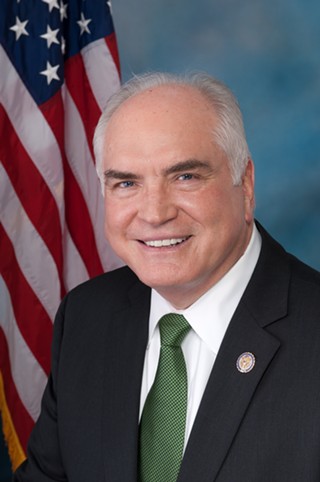

The U.S. House passed a bipartisan bill banning the IRS from creating an improved free electronic tax filing system on April 9. The Taxpayer First Act, which makes several administrative changes to the IRS, is co-authored by U.S. Rep. John Lewis (D-Ga.) and local congressman Mike Kelly (R-Butler).

“The IRS is one of few federal agencies that Americans, whether they like it or not, will have a constant relationship with throughout their lives,” Kelly said in an April 9 press release. “The bill we passed today will make sure that relationship is built on trust rather than fear, and that taxpayers’ rights are safeguarded when they interact with the agency.”

Kelly argued that the bill makes the IRS a resource, not an adversary to Americans.

The act codifies the “Free File” system, an existing understanding between the IRS and the private taxpaying industry which allows most Americans to file for free online but only through private services. The IRS pledges not to create its own online filing system, which, in theory, encourages private companies to offer free filing to low-income taxpayers.

In 2013, ProPublica reported on efforts made by taxpayer-industry lobbyists to ensure the IRS didn't provide free and simplified tax-returns to all Americans.

The Free File Alliance, a private industry group, says 70 percent of American taxpayers are eligible to file for free online through the IRS called Free File. (Paper filings are still free, no matter the income level.) However, the Washington Post reported that only about 2 percent of eligible individuals use the free IRS software and note that it's not well-publicized.

A group of Democrats tried to stall the Taxpayer First Act prior to its passing, criticizing the provision preventing the IRS from developing a free system. Reps. Katie Hill (D-Calif.) and Alexandria Ocasio-Cortez (D-N.Y.), both spoke against the measure but eventually were persuaded by backers who said the bill contains significant victories for low-income Americans, including protection for low-income taxpayers from private debt collection agencies and $30 million in matching grants for a program that provides help to low-income taxpayers.

Experts have long argued that the IRS could make filing taxes far easier and cheaper, especially by adding a free online system like those provided in countries such as the United Kingdom and Germany. The result is that filing taxes is free and significantly faster than it is in the U.S., Jeremy Bearer-Friend, a tax law expert at New York University, told the Post.

“The tax filing system has been captured by a lucrative industry and they guard it jealously,” Bearer-Friend said in the Post. “Our government should provide a free public option for paying taxes. We shouldn’t have to spend our own money on our own tax filing obligations.”

A companion Senate bill with the same provision has been introduced by Sens. Chuck Grassley (R-Iowa) and Ron Wyden (D-Ore.). The bill has earned new scrutiny due to the concern raised over the IRS provision, according to ProPublica.

Grassley and Wyden disagree that the bill would permanently bar the IRS from creating its own product to compete with the commercial tax preparation industry. Experts such as Bearer-Friend, however, assert that the language of the bill is designed to force the IRS to stick with the Free File program.

The U.S. House passed a bipartisan bill banning the IRS from creating an improved free electronic tax filing system on April 9. The Taxpayer First Act, which makes several administrative changes to the IRS, is co-authored by U.S. Rep. John Lewis (D-Ga.) and local congressman Mike Kelly (R-Butler).

“The IRS is one of few federal agencies that Americans, whether they like it or not, will have a constant relationship with throughout their lives,” Kelly said in an April 9 press release. “The bill we passed today will make sure that relationship is built on trust rather than fear, and that taxpayers’ rights are safeguarded when they interact with the agency.”

Kelly argued that the bill makes the IRS a resource, not an adversary to Americans.

The act codifies the “Free File” system, an existing understanding between the IRS and the private taxpaying industry which allows most Americans to file for free online but only through private services. The IRS pledges not to create its own online filing system, which, in theory, encourages private companies to offer free filing to low-income taxpayers.

In 2013, ProPublica reported on efforts made by taxpayer-industry lobbyists to ensure the IRS didn't provide free and simplified tax-returns to all Americans.

The Free File Alliance, a private industry group, says 70 percent of American taxpayers are eligible to file for free online through the IRS called Free File. (Paper filings are still free, no matter the income level.) However, the Washington Post reported that only about 2 percent of eligible individuals use the free IRS software and note that it's not well-publicized.

A group of Democrats tried to stall the Taxpayer First Act prior to its passing, criticizing the provision preventing the IRS from developing a free system. Reps. Katie Hill (D-Calif.) and Alexandria Ocasio-Cortez (D-N.Y.), both spoke against the measure but eventually were persuaded by backers who said the bill contains significant victories for low-income Americans, including protection for low-income taxpayers from private debt collection agencies and $30 million in matching grants for a program that provides help to low-income taxpayers.

Experts have long argued that the IRS could make filing taxes far easier and cheaper, especially by adding a free online system like those provided in countries such as the United Kingdom and Germany. The result is that filing taxes is free and significantly faster than it is in the U.S., Jeremy Bearer-Friend, a tax law expert at New York University, told the Post.

“The tax filing system has been captured by a lucrative industry and they guard it jealously,” Bearer-Friend said in the Post. “Our government should provide a free public option for paying taxes. We shouldn’t have to spend our own money on our own tax filing obligations.”

A companion Senate bill with the same provision has been introduced by Sens. Chuck Grassley (R-Iowa) and Ron Wyden (D-Ore.). The bill has earned new scrutiny due to the concern raised over the IRS provision, according to ProPublica.

Grassley and Wyden disagree that the bill would permanently bar the IRS from creating its own product to compete with the commercial tax preparation industry. Experts such as Bearer-Friend, however, assert that the language of the bill is designed to force the IRS to stick with the Free File program.