Wednesday, October 19, 2011

Magazine offers tax proposal for Occupiers to rally behind

One of the frequent criticisms of the Occupy Pittsburgh movement, and similar protests taking place in cities around the nation, is that for all its complaints about economic inequality, it offers few solutions.

That may change in the next few weeks.

Adbusters -- the countercultural magazine that launched the Occupy movement -- has put out the call for another demonstration: an Oct. 29 rally for a tax on global financial trading.

In an Oct. 17 blog post, the magazine called for a demonstration espousing a "Robin Hood" tax:

On October 29, on the eve of the G20 Leaders Summit in France, let's the people of the world rise up and demand that our G20 leaders immediately impose a 1% #ROBINHOOD tax on all financial transactions and currency trades. Let's send them a clear message: We want you to slow down some of that $1.3-trillion easy money that's sloshing around the global casino each day -- enough cash to fund every social program and environmental initiative in the world.

Take this idea to your local general assembly and join your comrades in the streets on October 29.

The tax, also known as the "Tobin tax," would take a tiny cut of financial transactions, like stock sales and currency trades. The goal of the tax is twofold: First, to raise money from rich financial markets, and give it to poorer communities; and second, to reduce the volatility of financial markets by attaching a cost to each transaction. Proponents say that the tax will reduce the endless "churn" in financial markets, and that it would land hardest on speculators and Wall Street insiders engaged in computer-driven "fast-trading." Such trading capitalizes on very short-term fluctuations in price, creating potentially massive instability without providing much benefit for the larger economy.

The tax is not a new, or even radical, idea. It has been backed by more than 1,000 economists worldwide, including New York Times columnist Paul Krugman and Jeffrey Sachs, who have urged the tax be adopted by the G-20. In a letter to the leaders of the world's leading economies, the economists wrote:

The financial crisis has shown us the dangers of unregulated finance, and the link between the financial sector and society has been broken. It is time to fix this link and for the financial sector to give something back to society.Even at very low rates of 0.05% or less, this tax could raise hundreds of billions of dollars annually and calm excessive speculation.

But as you might expect, there's been plenty of opposition to the tax proposal -- largely from the financial sector and its advocates. While countries in the European Union have supported the idea, it has been blocked by a coalition of the United States, Canada, and Great Britain. Critics contend that financial institutions would simply pass the cost along to customers, and argue that it would make development more difficult in poorer nations, because it would increase the cost of raising money.

Another objection is that such a tax scheme would have to be adopted universally -- in every country -- or else financial institutions would simply begin channeling their financial operations through, say, Asia. The very thing that makes this tax desireable -- the ease with which capital can transcend national borders -- would make it difficult to pass.

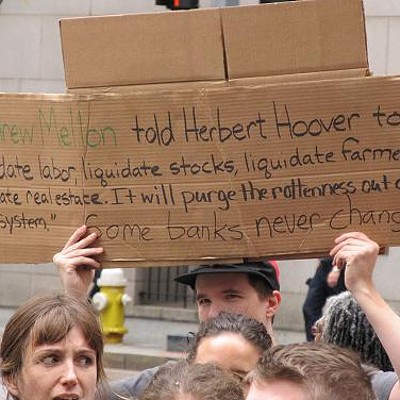

It's not clear yet whether Occupy Pittsburgh or similar movements in other cities will be taking part in the Oct. 29th protest: Decisions about protest goals and tactics are made by the "general assembly" of each city's Occupiers. It's worth noting, though, that Occupy Pittsburgh will be demonstrating outside BNY Mellon at 11:30 this morning. And guess what financial misdeed BNY Mellon has been accused of? Reaping too much money from foreign currency trading.

Tags: Slag Heap